Home > Commercial

Commercial Solar Solutions

Make Solar Power Your Business… While saving big with federal tax credits and other federal and state tax benefits.

While many homeowners in Northern California have embraced solar energy, it’s equally beneficial for business and commercial property owners. Whether you operate a large corporation or a smaller business, solar power offers a sustainable solution that can enhance your profitability while promoting environmental responsibility.

By investing in solar energy, you can take control of your energy costs, reducing reliance on traditional utility providers and insulating your business from fluctuating energy prices. With various financing options available, you can find a solution that aligns with your budget and financial goals.

Implementing solar power not only creates a positive impact on your bottom line but also enhances your brand's reputation. More consumers are prioritizing sustainability in their purchasing decisions, and by adopting green energy practices, your business can attract environmentally conscious customers.

Furthermore, many state and federal incentives are available to help offset the initial installation costs. Our team at Brighter Solutions Energy Consulting is here to guide you through the entire process—from assessing your solar potential to designing a customized system that meets your specific needs.

Make the transition to solar and unlock the potential for significant savings, increased energy independence, and a greener operation! Join the growing number of businesses in Northern California that are reaping the benefits of solar energy and leading the charge towards a sustainable future.

Maximize Solar Tax Savings

Get a Federal Tax Break

Did you know the United States government offers a 30-percent tax credit (investment tax credit) to businesses that installation solar power systems? This federal tax credit can be taken all at once or over several years, regardless of how much your installed system costs.

Additional State/Federal Tax Benefits

In addition to the 30-percent federal tax credit under the Federal modified accelerated cost/recovery system (MACRS), businesses may recover investments with a corporate depreciation.

Save by Going Green

Does it make good business sense to continue paying thousands of dollars each month to the local utility? Wouldn't you rather save in the long run by purchasing a solar power system for your business? By depreciating the cost of your system with Modified Accelerated Cost Recovery, the Federal Investment Tax Credit, and avoided energy costs, your business can recoup 100 percent of your investment within just a few years.

Green is Red Hot

Businesses that go green are now recognized as community leaders. Many consumers feel better about supporting businesses that help promote a cleaner environment. Your business will greatly benefit from being able to promote itself as a green business that has incorporated environmentally friendly business practices.

No Capital Outlay Options

Do you want to go green but have concerns about how much up-front cost will be involved? Brighter Solutions has the resources and partners to offer operational and equipment leasing options with no upfront cost. If your business meets certain criteria, we can provide your business with a solution that does not require you to provide an upfront cost.

Please contact us for more information on whether your business qualifies for the no upfront cost option.

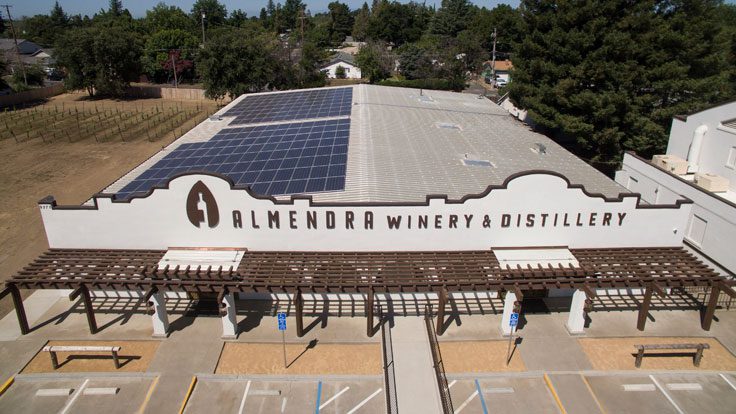

Commercial Solar Solutions Gallery

Get a Federal Tax Break.

Save by Going Green.

Solar power could hold the key to helping you become profitable.